- #Last date to file extension 2016 how to#

- #Last date to file extension 2016 install#

- #Last date to file extension 2016 windows 10#

- #Last date to file extension 2016 android#

The close of the tax year (e.g., Florida Form F-1120 is due on May 1, 2017, for a taxpayer with a taxable year end date of December

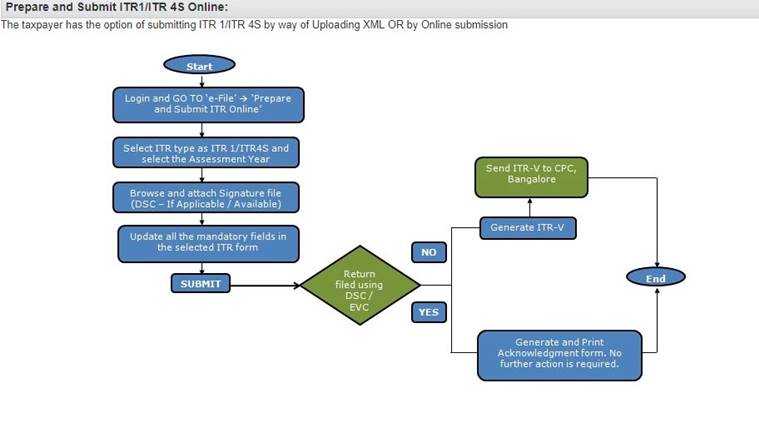

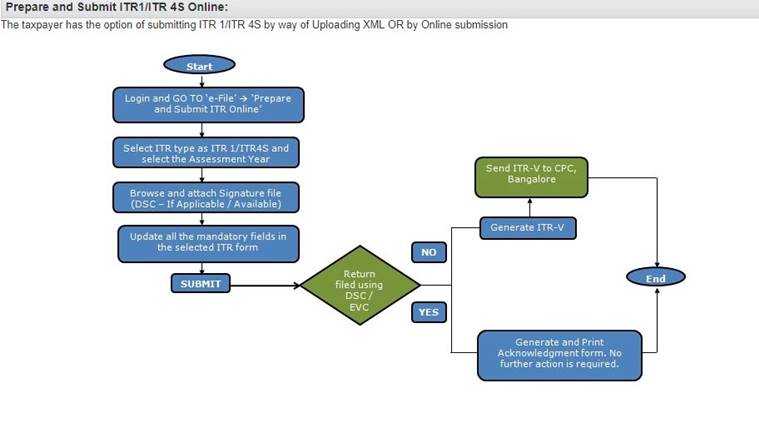

Generally, Florida Form F-1120 is due the later of: 1.įor tax years ending June 30, the due date is on or before the 1st day of the 4th month followingįor all other tax year endings, the due date is on or before the 1st day of the 5th month following The due date is based on the corporation’s tax year. Corporations must file Florida Form F-1120 each year, even

Tax-exempt organizations that have "unrelated trade or business income" for federal income tax purposes are subject to Florida corporate income taxĬorporate income tax is reported using a Florida Corporate Income/Franchise Tax Returnį-1120 ). S corporations that pay federal income tax on Line 22c of Federal Form 1120S. Political organizations that file Federal Form 1120-POL. (Federal Form 1120-H), you are not required to file a Florida return. Income Tax Return for Homeowners Associations Must file Florida Corporate Income/Franchise Tax Return ( Form F-1120 ) or theįlorida Corporate Short Form Income Tax Returnį-1120A) regardless of whether any tax may be due. Corporation Income Tax Return (Federal Form 1120) Homeowner and condominium associations that file the U.S. The corporation must file a FloridaĬorporate income/franchise tax return, reporting its own income and the income of the single member LLC, even if the only activity of the corporation is ownership of The income must be reported on the owner’s return if the single member LLC is owned, directly or indirectly, by a corporation. A single member LLC disregarded for federal and Florida income tax purposes is not required to file a separate Florida corporate income tax return. In addition, the corporate owner of an LLCĬlassified as a partnership for Florida and federal income tax purposes must file a Florida corporate income/franchise tax return. ) if one or more of its owners is a corporation. An LLC classified as a partnership for Florida and federal income tax purposes must file a. A limited liability company (LLC) classified as a corporation for Florida and federal income tax purposes is subject to the Florida Income Tax Code and mustįile a Florida corporate income/franchise tax return. A "Florida partnership" is a partnershipĭoing business, earning income, or existing in Florida. Foreign (out-of-state) corporations that are partners or members in a Florida partnership or joint venture. All associations or artificial entities doing business, earning income, or existing in Florida. Every bank and savings association doing business, earning income, or existing in Florida. All corporations (including tax-exempt organizations) doing business, earning income, or existing in Florida. More information about CRDOWNLOAD files - CRDOWNLOAD file analysis. #Last date to file extension 2016 windows 10#

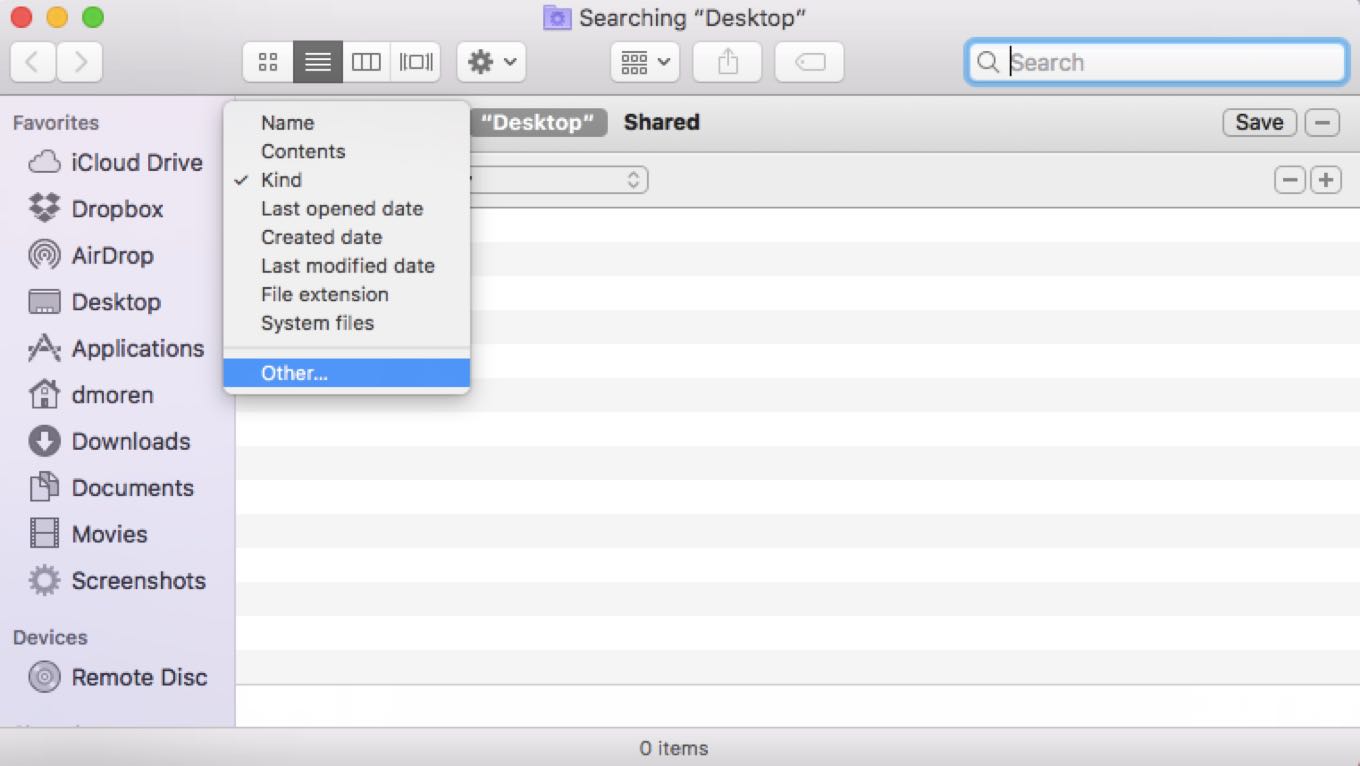

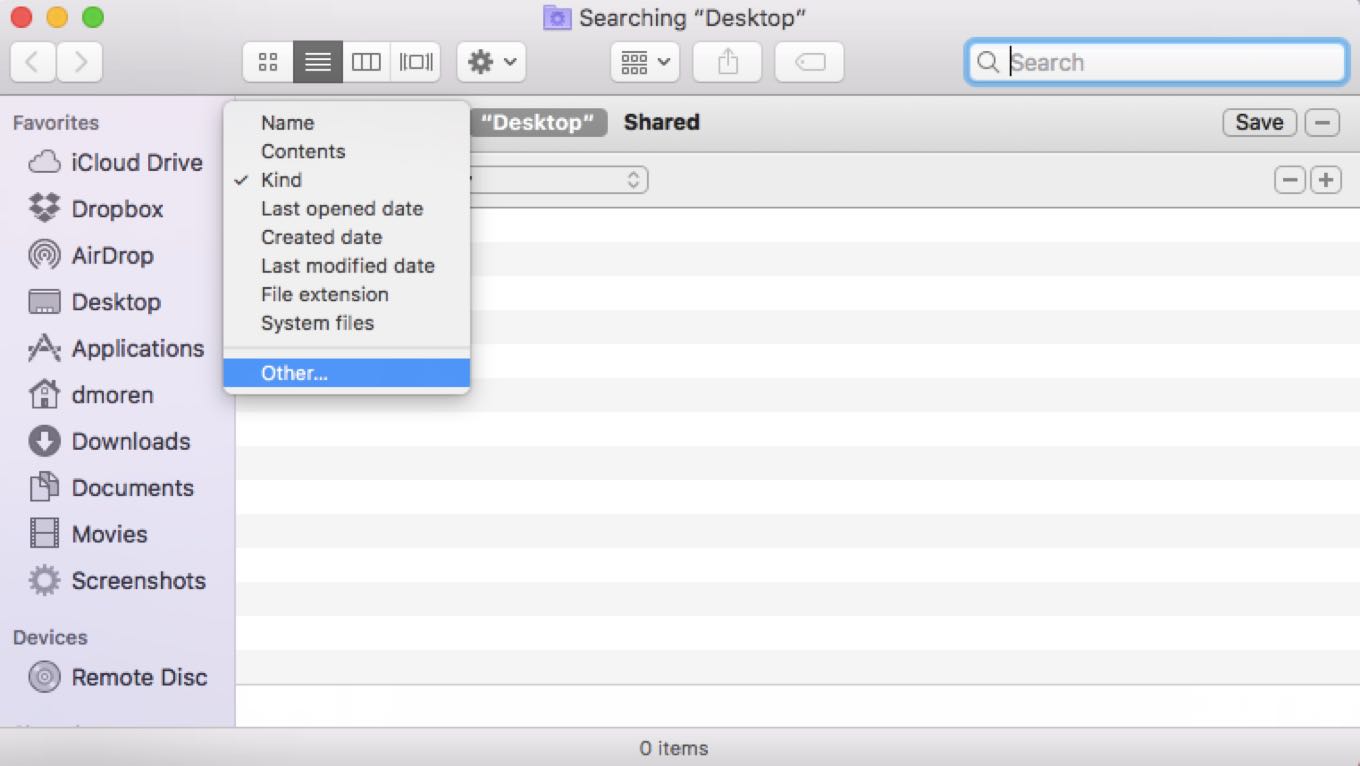

Show and hide file extensions in Windows 10. Search file extensions from Windows context menu - Directly search 's database by single click from Windows context menu upon an unknown file. #Last date to file extension 2016 how to#

How to open pkpass file - Additional information about pkpass files and how to open and convert them. Best programs for finding duplicate files - Programs for file duplicity searches. How to convert WhatsApp CRYPT files - Decrypting WhatsApp message databases. Open HEIC pictures in Windows - Adding HEIF support to your computer with Copytrans HEIF for Windows. #Last date to file extension 2016 install#

How to install a virtual PostScript printer in Windows - Using universal PS drivers to install virtual printer in latest Windows.

#Last date to file extension 2016 android#

How to run Android apps in Windows - Using BlueStacks App Player to run Android apps from Windows Sidebar.How to work with OXPS documents without Windows 8 - Handling OXPS documents in older Windows.Check out the recently published articles related to file extensions, tutorials or software tips.

0 kommentar(er)

0 kommentar(er)